Retirement Planning

Start planning for a more financially secure retirement. MoneyGuidePro®** can help.

Create Your Personalized Retirement Plan

Retirement can mark the beginning of a new adventure. Do you want to start a business? Travel? Invest in real estate? Golf every day? MoneyGuidePro will help you shape a financial plan, so that when the time comes, you’ll be ready for your new adventure.

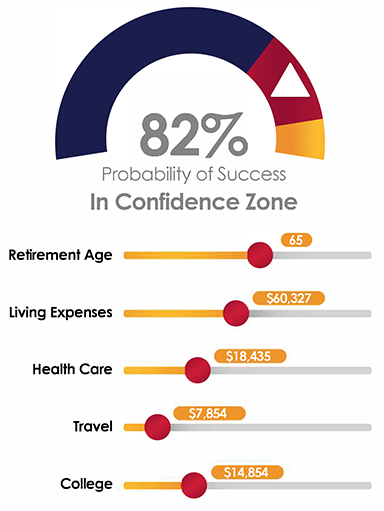

MoneyGuidePro helps you identify the things you want to afford in retirement and budgets them on an easy-to-understand dashboard:

- Living expenses

- Healthcare

- Travel

- College expenses for your children

Compare what you want to spend, to what you’re on track to earn, and you’ll get a Confidence Zone score.

Make changes to your plan—such as raising your retirement age—and watch your Confidence Zone score go up.

Ready to Get Started?

Learn more about how MoneyGuidePro can help you manage all of life’s big financial decisions and achieve your long-term goals.

- Watch the video to learn more about the benefits of financial planning

- Visit the MoneyGuidePro page

- View the retirement brochure and see the Confidence Zone dashboard in action

- See how your financial plan will look. View a sample retirement plan

Tax-Smart Retirement Income for You and Your Business

An investment strategy helps you sleep better knowing you will be able to enjoy your retirement. We can help you build savings in a tax-advantaged retirement account to supplement a pension or consolidate existing accounts you may have. So, when you make the transition to retirement, you’ll be ready to turn your savings into an income stream.

IRAs offer tax advantages to encourage you to save for your retirement. There are different IRAs for different financial situations.

Types of IRAs:

|

|

Use our IRA Options Calculator to find out the maximum amount you can contribute. It will also help you determine if you are eligible to contribute to both Traditional and Roth IRAs.

Just tell us a little about your business. We’ll simplify choosing the right plan for your situation.

Types of 401(k)s:

|

|

Schedule a Meeting

Before deciding to retain assets in an employer sponsored plan or roll over to an IRA, an investor should consider various factors including, but not limited to: investment options, fees and expenses, services, withdrawal penalties, protection from creditors and legal judgments, required minimum distributions and possession of employer stock.

*Non-deposit investment products and services are offered through CUSO Financial Services, L.P. (“CFS”), a registered broker-dealer (Member FINRA/ SIPC) and SEC Registered Investment Advisor. Products offered through CFS: are not NCUA/NCUSIF or otherwise federally insured, are not guarantees or obligations of the credit union, and may involve investment risk including possible loss of principal. Investment Representatives are registered through CFS. The Credit Union has contracted with CFS to make non-deposit investment products and services available to credit union members.

**©MoneyGuide, Inc. Reproduced with Permission. All rights reserved.